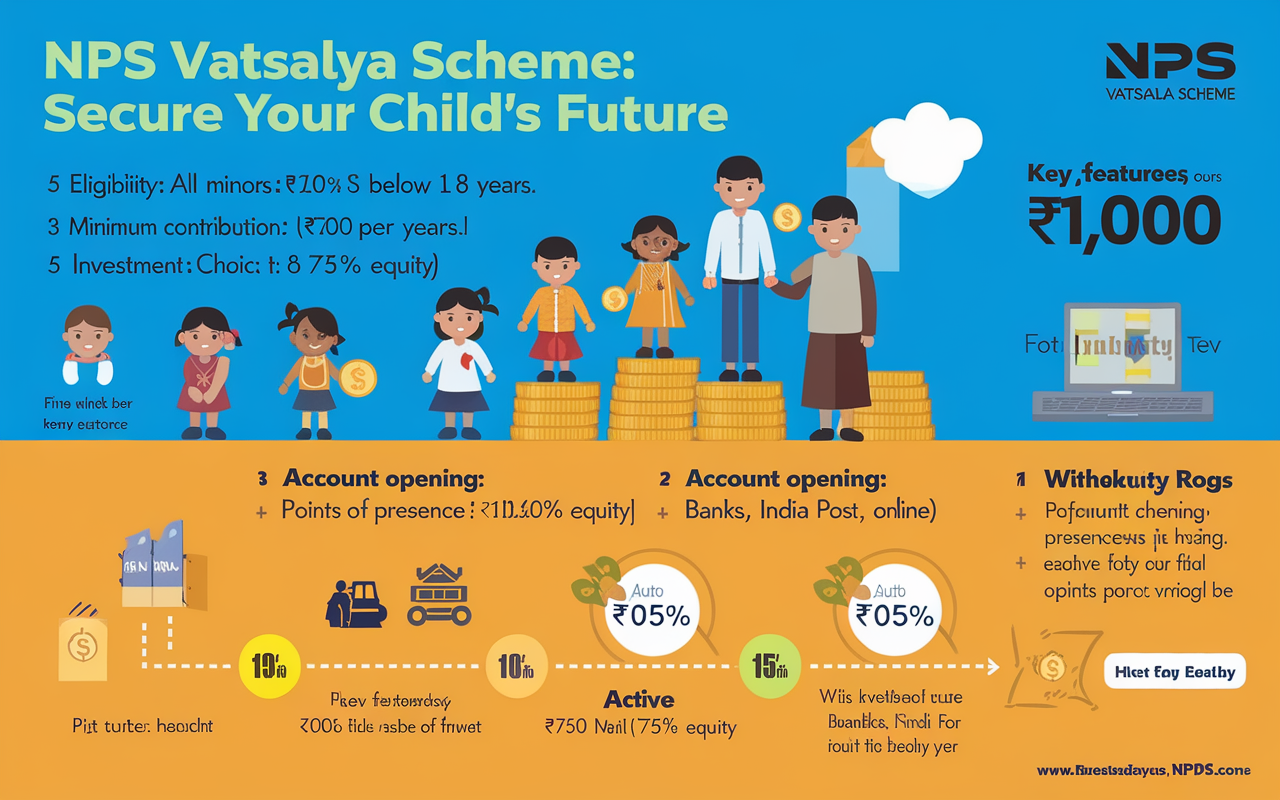

In a significant move to secure the financial future of children, Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, recently launched the NPS Vatsalya Scheme. Announced in the Union Budget 2024-25 on July 23, 2024, this initiative is designed as a pension scheme specifically for minors, ensuring that even young members of the family have a safety net for their future.

What is NPS Vatsalya?

The NPS Vatsalya scheme is an extension of the existing National Pension System (NPS) aimed at providing a structured saving mechanism for children under 18 years. This scheme operates on the principle of intergenerational equity, allowing parents and guardians to create a retirement corpus for their children from an early age. Children enrolled in this scheme will receive a Permanent Retirement Account Number (PRAN) card, which marks their initiation into the NPS.

Key Features of NPS Vatsalya

- Eligibility:

- All minor citizens (below 18 years) are eligible to enroll.

- The account is opened in the child’s name but operated by a parent or guardian, making the minor the sole beneficiary.

- Contribution Requirements:

- A minimum initial contribution of ₹1,000 is required annually, with no upper limit on contributions.

- Investment Choices:

- Default Choice: Moderate Life Cycle Fund (50% equity).

- Auto Choice: Guardians can select from Lifecycle Funds with varying equity exposure based on their risk appetite (Aggressive – 75% equity, Moderate – 50% equity, Conservative – 25% equity).

- Active Choice: Guardians can actively decide the fund allocation across equity, corporate debt, and government securities.

- Account Opening:

- Accounts can be opened through Points of Presence (POPs) registered with the Pension Fund Regulatory and Development Authority (PFRDA) such as major banks, India Post, and online platforms (e-NPS).

- Documents Required:

- Proof of the child’s date of birth (e.g., birth certificate, school leaving certificate).

- KYC documentation for the guardian (e.g., Aadhaar, passport, voter ID).

- Additional documents may be required for NRI guardians.

Withdrawal and Transition Policies

- Partial Withdrawals: Up to 25% of the contributions can be withdrawn after a lock-in period of three years for specific needs like education or health emergencies.

- Upon Turning 18: The NPS Vatsalya account automatically converts to a regular NPS account. If the corpus is equal to or exceeds ₹2.5 lakh, at least 80% must be used to purchase an annuity, with the remainder available as a lump sum. If the corpus is less than ₹2.5 lakh, the entire amount can be withdrawn as a lump sum.

- In Case of Death: If the minor or guardian passes away, the accumulated corpus will be returned to the registered guardian or a new guardian can be appointed.

Conclusion

The NPS Vatsalya scheme offers an excellent opportunity for parents to plan for their children’s financial future, allowing them to instill a habit of saving and investing from a young age. By ensuring a structured pension plan, parents can provide their children with a solid foundation for financial security.

To know more about this scheme or to apply online, visit the PFRDA website or the nearest registered Point of Presence.